Why you should Pay off Your own Mortgage Past

Imagine you bought a home your day once you graduated out-of high-school, while grabbed aside a 30-12 months financial. You pay the bill dutifully toward length of the mortgage. You will be nearly half a century old after you improve past percentage.

Although we wished to work on spending our very own financial of early, we along with knew we wish to begin paying all of our mortgage immediately after everything else is repaid. Luckily for us, i started the obligations-100 % free excursion in years past and been able to move on to all of our financial purpose.

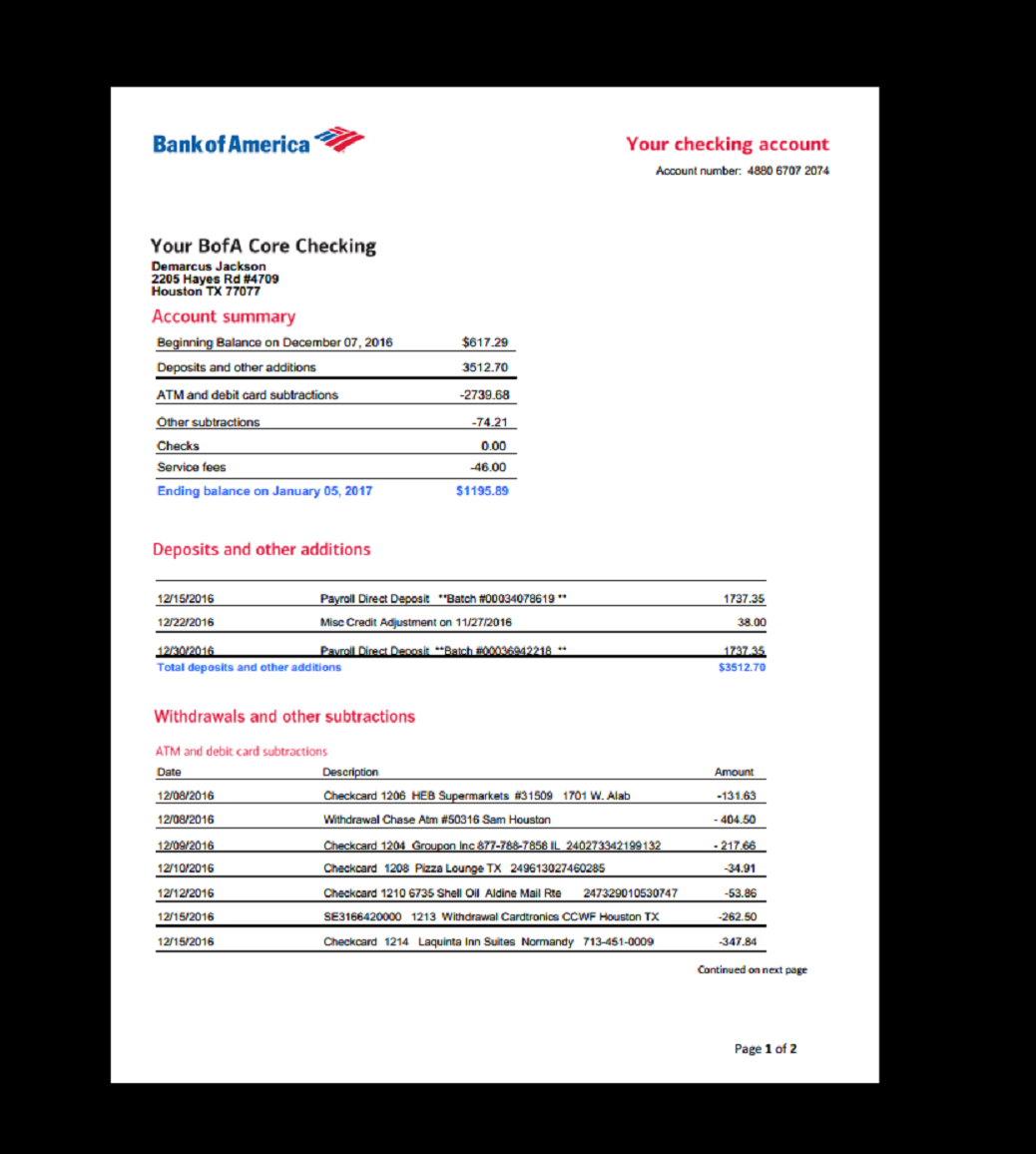

If you are like any Us americans, you really have personal credit card debt, student loan obligations, and you may automobile debt. You will want to spend this type of off before starting organizing more cash at your financial.

Imagine you will do the alternative initiate expenses more on your own mortgage, all additional cent there are. Then you’ve got some kind of disaster that creates one to end up being unemployed to own eight months. Your income are drastically cut-in the latest brief, and though you are back to are employed in one or two days, how will you pay their bills in the meantime?

Accomplish that One which just Pay Additional

After you have an emergency finance, start with paying down their non-mortgage costs, so you will have your revenue freed upwards to utilize towards home loan.

Imagine you may have paid all of your costs except your home loan. For you personally to throw all buck this way, right? Not too timely. It’s adviseable to be purchasing money to own old-age at a rate regarding 18% of money. You will not want to get at retirement age down the trail and get a premium-from family however, zero nest-egg on what to live.

Very, once you initiate paying for a price regarding 18% of the earnings on old-age accounts, Up coming begin organizing all the a lot more buck in the financial.

The sort of home mortgage issues

By paying into the an adjustable-rates financial, this may be often to evolve every year. The eye pricing might go up or down based on how better the brand new savings really does over the years. Thus, even though you might think that you’re providing a great contract now, often there is something else entirely future together later.

How you can prevent this matter is with a fixed-price mortgage. That have a fixed-price financial, you secure to the a set number each month.

Exactly why you Mathematically Shouldn’t Pay back Your Mortgage Very early

Mathematically, it generally does not seem sensible to repay your own mortgage very early. Which have over the years reasonable-rates of interest (hovering doing step three%), it appears to be almost dumb to blow more money to settle your property very early.

Think about it you could dedicate your bank account inside the a keen S&P Directory Loans throughout the stock market and come up with an average out of 8% from year to year. Which is a beneficial 5% difference between using the cash to end a great 3% interest towards a mortgage in the place of paying it and and then make 8%.

Figuring Inside Monetary Versatility And Economic Protection

But not, the above condition concentrates found on a statistical direction. The brand new calculations seem sensible statistically for people who disregard the curveballs life sets during the united states. For people who invest your own more funds but lose your task and can no longer afford your own home loan, brand https://elitecashadvance.com/loans/cash-till-payday-loan/ new statistical formula goes out the windows.

My spouse and i chose monetary cover in the place of expanding the net value. We did so it because of the maxing out our very own advancing years finance basic and you will next investing most of the additional cent on the repaying the borrowed funds.

From the going it route, i squandered five years out of extra output nevertheless now i have no home loan and can subcontract much more currency towards investments.