USDA Loan Supplier Concessions: Advantages and disadvantages

step 1. Dump Settlement costs

One of the first benefits associated with vendor concessions to have USDA finance is the ability to reduce the economic weight off settlement costs on your new home. Closing costs can also be gather in order to a large amount. Being able to discuss into the supplier to fund a percentage of those expenditures tends to make a hefty difference in your current financial situation.

1. Quicker Appealing to Providers

Whenever you are vendor concessions are beneficial to buyers, they truly are seen as faster tempting on seller’s direction. When multiple even offers are on the fresh new dining table, sellers usually consider various items, for instance the net continues they discovered just after layer concessions. Consequently, buyers just who require significant concessions get face way more pressures during the persuading providers to just accept the provide, particularly in aggressive real estate markets.

dos. Prospective Rise in Loan amount

Particular consumers may choose to generate a slightly highest provide on the a home to remain aggressive whenever asking for merchant concessions. This 1 produces the new initial will set you back significantly more in check if you’re nevertheless keeping a nice-looking render, but it’s crucial that you think about the enough time-label ramifications of the strategy. Boosting your full amount borrowed mode you’ll accumulate even more attention across the life of your loan, probably ultimately causing higher total costs.

For example, imagine you’re interested in a house value $250,000, as well as your settlement costs is estimated on $7,five-hundred. You might choose raise your complete promote so you can $257,five hundred however, require provider concessions. Although this means enables you to manage your own immediate cash circulate and remain competitive on the seller’s direction, you are going to accrue much more focus over the years as you are getting away a much bigger USDA financing.

step 3. Needs Settlement with payday loan alternatives Arkansas Vendor

Discussing seller concessions needs effective correspondence and you can compromise between the client plus the merchant. It may not be a straightforward process, because the both parties are seeking to maximise their advantages. People need to means the fresh discussion tactfully, knowing the seller’s motives being prepared to make a powerful circumstances having as to the reasons the fresh concessions are sensible and you may collectively beneficial for both sides.

How exactly to Discuss Merchant Concessions

Settling provider concessions is going to be a strategic procedure that requires mindful believed and you may efficient communication between the consumer and you may supplier.

See your budget: Dictate the most you could comfortably afford to suit your total amount borrowed. This knowledge provides you with a stronger basis getting discussing provider concessions rather than overstretching your bank account.

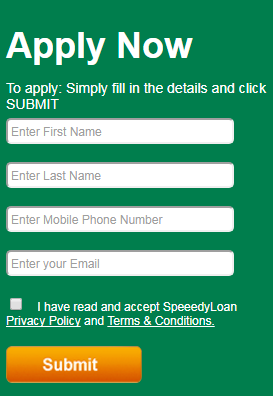

Get pre-acknowledged to suit your USDA loan: Finding good USDA mortgage preapproval does not only make it easier to influence the budget for potential properties also reveals sellers you to youre a significant and you can certified client. This may leave you a bonus within the deals and you may have shown your monetary maturity so you’re able to go-ahead along with your domestic buy.

Comprehend the seller’s perspective: Set your self on seller’s footwear and you will think its reasons. Will they be looking to promote easily, otherwise carry out they have time for you expect a far greater bring? Understanding the seller’s state can present you with beneficial insights in order to personalize your settlement approach. Oftentimes, giving a slightly high price with vendor concessions is more inviting than just less provide as opposed to concessions.

Consider the newest housing industry: That have a thorough understanding of the modern housing market is rather dictate their method of negotiating merchant concessions. From inside the a buyer’s industry where there can be alot more collection than consult, manufacturers may be far more offered to giving concessions to draw customers. In an excellent seller’s industry where there clearly was high demand but limited inventory, suppliers can be less likely to want to bring concessions because they are likely to found several aggressive even offers on the list.

Work on a talented agent: A seasoned agent who’s accustomed USDA funds and you can deals is a valuable asset throughout the homebuying techniques. These types of agents makes it possible to browse merchant concessions and you can make suggestions from the settlement techniques if you’re ensuring that their bring stays aggressive and enhances your own advantages.