three straight ways to reduce student loan loans just before Biden’s money freeze ends up

Us citizens have been worried about federal education loan payments resuming during the October averted work after Chairman Joe Biden’s management made a decision to expand new freeze into repayments and you can attract getting an extra five months.

It means new about 42 mil government student loan borrowers is from the connect up to . Biden’s Department of Knowledge cautioned this particular try the newest “final expansion” regarding a pause on college student financial obligation that’s been positioned just like the .

If you have student loans along with your small personal loans Long Beach cash have organized pretty well during the pandemic, take advantage of these types of history days of your own moratorium to pay off away normally of these personal debt too.

step 1. Create money, even if you don’t have to

Even though it might possibly be appealing to stay “towards the break” from the student loans up until February, continuous your own regular repayments – and even purchasing over your typical lowest – is actually a sensible tip, if you’re able to afford it.

Given that interest rates with the government figuratively speaking was suspended on 0%, one payments you will be making today goes completely on the the principal of the loan.

It means you may be in a position to capture a decent amount from your own loan equilibrium. When student loan debt is suspended just last year, an average equilibrium is $20,000 in order to $twenty-four,999, predicated on Government Put aside study.

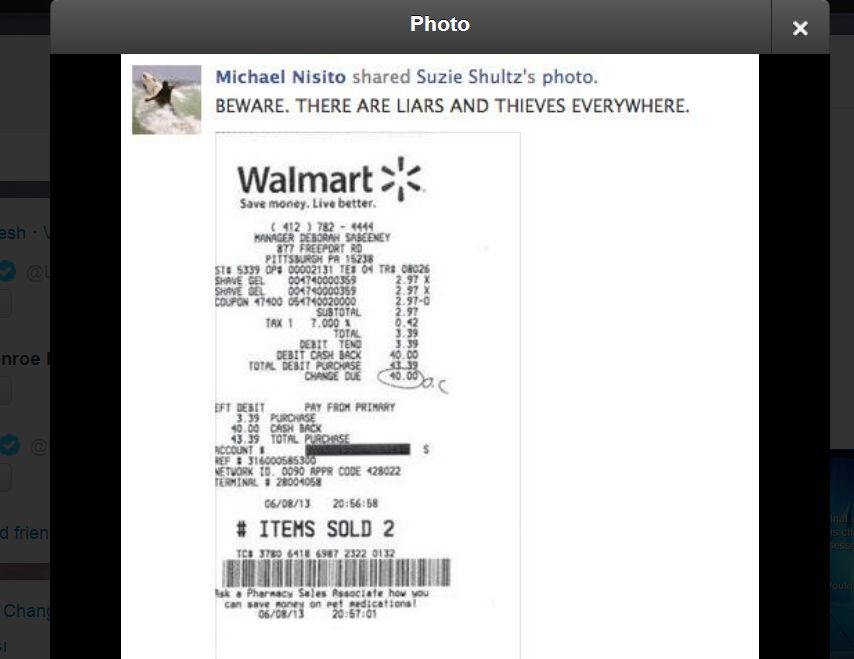

Resuming your payments early is probably impossible in the event that you will be writing about most other expense, including for individuals who went your playing cards throughout an occasion off unemployment this past year. You.S. Education Secretary Miguel Cardona said when you look at the a job interview last week you to officials was searching for alternative methods to ease the burden to the student loan individuals, in the fresh new meantime, your age men and women expenses with the help of a reduced-desire debt consolidation loan.

2. Find a different installment package

You could potentially clear their student loan financial obligation shorter of the switching upwards your fee bundle, especially if the pandemic reduce your earnings therefore still has not go back.

The us government even offers money-inspired repayment agreements that allow borrowers and also make cheaper money, predicated on what they earn. Once you make 20 otherwise 25 years off normal money around a living-inspired bundle, their remaining personal debt might be forgiven.

That will be your best decide to try on having the the college loans terminated. President Biden campaigned for the cleaning aside $10,100 within the scholar obligations for every borrower, and you can best Democrats was clicking your to consult with $50,000 – but you’ll find inquiries now over whether Biden has the authority to help you forgive big college student financial obligation.

One easy money-rescuing action which have a federal education loan is to try to enroll in autopay because the joining automatic places tend to meet the requirements you for a great 0.25% rate of interest cures whenever costs restart.

step 3. Refinance private loans

When your figuratively speaking are from a personal lender and not the federal government, new longer repayments stop does not connect with you. But you can assault the college student obligations over the next partners days of the refinancing your loan just like the rates toward refi scholar financing off private lenders was at the historically low levels.

If you be eligible for refinancing will largely count on the borrowing score as well as your newest money. If you’re not sure regarding your score, it’s easy to look at the credit score 100% free on the web.

Even though you forgotten your task due to the pandemic, you’re eligible for a good refi if you possibly could let you know financing money otherwise income away from a part concert, otherwise look for an excellent co-signer in order to straight back the application. For top speed in order to re-finance a student loan, you will need to shop around and you will evaluate estimates regarding multiple loan providers.

Keep in mind that refinancing isnt a choice if you have a federal education loan, and you can substitution a national loan which have a private you to definitely will make you ineligible when it comes down to subsequent financing rescue actions in the bodies.

This post brings pointers simply and cannot feel construed just like the suggestions. Its considering in place of assurance of any sort.