The fresh new PMI covers the lender if you default on your own mortgage

Find out about all downpayment choices, and exactly how you should buy a home loan with less than the new ideal 20% off.

To get property is actually arguably the most costly funding an average people could make within life. You can find very not many people who can buy a home outright in the place of checking out the mortgage processes and you may securing a mortgage. And you will those who have purchased a property will tell you: the 2 things you must be happy to dedicate try go out and money.

While you are time has become an extremely valuable (and you may scarce) item in today’s people, currency will performs more of a deciding reason behind the home buying techniques.

As a matter of fact, one of the most essential steps in to acquire a house is setting aside money getting a down payment on your own mortgage.

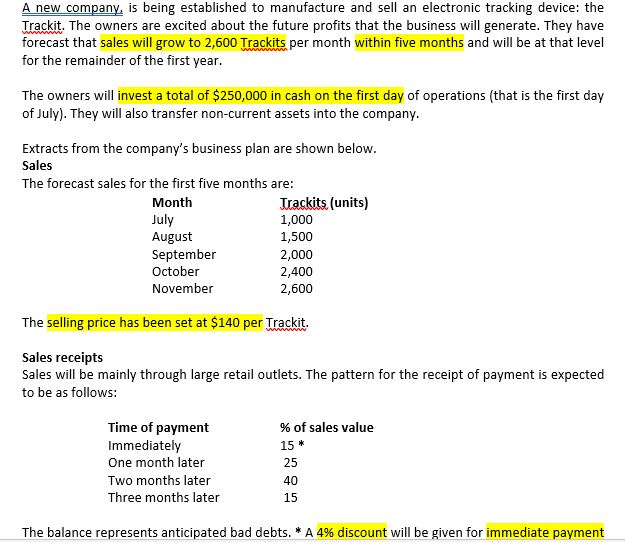

An advance payment to own a mortgage is a kind of payment you to is the reason a portion of your house’s total sale rate. Normally, down repayments are from 3 so you’re able to 20% of your home’s purchase price. You are typically required to result in the down payment initial (it is usually mentioned among the closing costs of home financing transaction), as a way to reduce the lender’s danger of loaning currency for your requirements, and also to demonstrate that you are capable of looking after your home loan instead of defaulting.

Down payments, in addition to credit scores, credit score, and your personal debt-to-earnings proportion (DTI), all are points of interest that lenders study. These issues help them see whether they want to loan you money or otherwise not, and exactly how much currency youre permitted borrow.

Expertise Off Payments

While looking for a home, you will more often than not discover rescuing right up enough currency to make an advance payment of 20% of one’s house’s business speed. If discovering one last part sent perhaps the littlest of shivers your back, don’t worry, you’re not alone. While you are 20% is the ideal down payment number, that does not mean youre bound to pay it when you shop having a home. In reality, there are actually more individuals who don’t put 20% off — particularly on their very first domestic.

Of several homebuyers don’t front you to definitely amount of money, whilst still being walk off which have an easily affordable financial and a gorgeous where you can find appreciate. With a lot of traditional fund, if you can’t make 20% down payment, you are going to need to shell out individual mortgage insurance rates (PMI) as part of your monthly mortgage repayments.

On the other hand, off costs together with play the role of a bargaining chip off manner. This is particularly true whenever negotiating rates of interest. Generally speaking, the better the new down payment, the greater (lower) rate of interest youre entitled to discover on your financial. Having said that, an advance payment out-of 20% or higher will give you your very best chance in the getting a reduced you’ll be able to interest rate.

Besides permitting discuss rates, putting some most useful advance payment amount of 20% can also help offer the aggressive benefit to the vendor out of property, in comparison with consumers which try not to create for example a huge initial payment.

Deciding to make the 20% deposit is definitely greatest, in no chance is-it very important to owning a home. The group at home.funds recommends you to definitely whoever wants buying property initiate rescuing right up currency well before birth your house to buy process, but if you don’t have enough to shelter 20% unsecured personal loans in Cleveland Ohio when the time comes, you should never fret. You still have many possibilities!

Bringing a conventional, compliant financial that have lower than 20% off a down-payment isn’t impossible — however you will most likely you would like high borrowing. If not, you will find several financing programs which can be a great deal more versatile which have its advance payment requirements than simply old-fashioned fund. Beyond one, you may be able to find deposit guidelines programs that can help you source the bucks and make that 20%.

If you don’t have a 20% down payment, as well as your credit actually from inside the great condition, thought among following unique financial software.

Special Financial Apps:

FHA Financing: The preferred choice for of several homebuyers ‘s the FHA mortgage, in which eligible individuals can also be set as little as 3.5% down. The fresh new trading-away from ‘s the inclusion out-of necessary home loan insurance fees (MIP) you to definitely improve your monthly payments. MIP can either be paid at the closure, otherwise it may be rolling with the cost of the loan.

Virtual assistant Financing: Arranged getting former or latest members of the us Equipped pushes (otherwise applicable family), you should buy a great Va mortgage no deposit. There’s also a great Virtual assistant financial support payment and therefore should be paid back.

USDA Loans: Such bodies-secure mortgage loans need no deposit, however they are tailored for a certain populace surviving in rigidly defined areas of the nation one identify given that lower income.

HomeReady Mortgage loans: Offered by Fannie mae, HomeReady mortgage loans enable it to be individuals to expend only step 3% down to own a single unit all the way to $417,000. Consumers need to be creditworthy is qualified, but lenders will in truth look at the earnings of all household members (instead of just the new candidate) when evaluating your eligibility. Financial insurance policy is required for so it mortgage.

Traditional 97 Loan: Tailored to the basic-date home buyers, the standard 97 financing allows down repayments only step 3% getting single unit property, and you will appear packaged due to the fact a 30-season repaired rate mortgage.

Employer-assisted construction (EAH) programs: Of many companies across the country give house finance assist with their group, some of which were deposit direction. Consult your businesses recruiting institution.

Vendors also can give down payment guidance. Such as for example, if the a supplier wishes to automate the home revenue processes, this may be a solution to continue some thing moving collectively. They’re able to actually sign up for title insurance premiums, property taxes, or settlement costs among other things. Discover limitations precisely how far a merchant can help, however, centered the sort of mortgage put.

Of many says have down payment assistance apps one to cater to this new local communities of cities and counties. There are in fact more than 2,000 ones programs in the country by 2018! There are even tips locate down payment direction software you to definitely youre entitled to. Experienced customers may also seek out down-payment guidelines programs from the county on the HUD site.