Possible Local rental Earnings Are used for Approval

The latest laws makes it necessary that the property need have indicated an ability to create adequate income to cover the working expenditures, including home loan repayments, assets repairs, and other associated will cost you. It is designed to slow down the risk of default and you will monetary instability to own FHA-covered money.

Local rental money for three or five products are determined for the appraiser’s imagine from a fair market rental rate, which is determined for all products, for instance the unit that you’re going to take. The new guess ‘s the deducted by 25%. This is actually the thinking-sufficiency decide to try. Having PITI, brand new month-to-month web-self-sufficiency income cannot go beyond 100% from three or four products.

What if a trader is interested when you look at the obtaining an FHA-covered loan to invest in the purchase regarding a beneficial multifamily assets. The newest FHA mind-sufficiency signal necessitates that the home generates enough local rental earnings to help you safety their doing work costs, for instance the mortgage payment.

If you are planning toward to order a multi-tool property having an enthusiastic FHA mortgage, you’ll be able to make use of prospective rental money having degree intentions

- Formula from Local rental Money:

- The home features a total of ten leasing equipment.

- For every single product is actually leased away having $1,000 30 days.

If you’re planning to the to acquire a multiple-product assets with an FHA loan, you’ll be able to use your possible local rental money to own certification motives

- Computation from Doing work Costs:

- Operating expenses tend to be assets taxation, insurance, restoration will cost you, and you may possessions administration costs.

- Let’s assume the entire month-to-month operating expenditures add up to $5,000.

If you’re planning on the to get a multi-product possessions having an enthusiastic FHA loan, you can make use of prospective leasing earnings to possess qualification purposes

- Computation away from Web Working Income (NOI):

- Internet Functioning Earnings is the difference in the full local rental earnings and you may performing expenditures.

If you are planning toward to purchase a multi-equipment property which have a keen FHA loan, it’s possible to make use of your potential local rental income to own qualification intentions

- Calculation away from Personal debt Solution (Mortgage payment):

In this analogy, the house matches the fresh FHA care about-sufficiency laws as Online Operating Money is sufficient to shelter the mortgage fee. Which displays to brand new FHA your house is economically feasible and has now the ability to build adequate earnings to fund the expenditures, reducing the chance of default towards the FHA-covered financing. Understand that these types of numbers are simplistic to own illustrative aim, and real computations may involve more in depth financial analysis and you will considerations.

Yet not, the potential money must be confirmed by bank, who’ll obtain a recommended leasing income that presents the newest fair markets lease because of the appraiser. If there is almost no history of rental income, the lender use Mode 1025 regarding Fannie mae otherwise Function 72 off Freddie Mac computer. Small Home-based Money Property Appraisal Statement are needed as well as will likely be through with the assistance of an experienced credit top-notch.

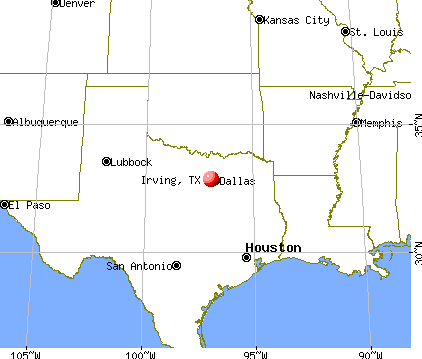

FHA Loan Constraints to own Multi-Devices Differ from the Area

The new FHA isnt in business to support the acquisition out of high priced otherwise deluxe house; instead, they work at help practical homeownership getting reasonable- and you will modest-income earners. As a result, there are particular limits on the fund, and these restrictions are different of the area.

Already, the product quality FHA loan limitations try $294,515. Although not, the number can go up if you reside inside a media otherwise large-rates area. In the higher-costs portion, the latest limits was:

There are even special exceptions that can allow you to explore financing to $1.96 mil americash loans Needham. Which high limitation is generally readily available when you are to find a good house in a few components of Their state, Alaska, Guam, or even the You.S. Virgin Islands. Basically, there are high design will set you back on these section, very limitations are increased so you can offset which debts.