Is actually an enthusiastic FHA mortgage right for you?

A familiar myth is that FHA money are merely for when you might be to invest in property the very first time. But you can qualify for one to even though you own good family or have possessed you to definitely.

Should anyone ever plan to re-finance the FHA mortgage along the range, you can look for the FHA Streamline re-finance to regulate your own rates or term, FHA cash-aside re-finance to get collateral from your home, or a keen FHA 203(k) loan to own family renovations.

FHA money has actually necessary MIP that can last for all of your current mortgage if you lay less than 10% down and for 11 age with at the least 10% off. This is distinctive from antique financing, where you could clean out personal mortgage insurance rates (PMI) that have 20% off.

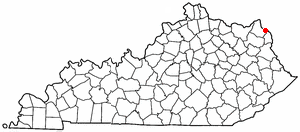

FHA mortgage limits will vary of the place and you can property type of but they are essentially $498,257 having solitary-equipment attributes in the all the way down-rates portion and you can $step one,149,825 from inside the higher-costs parts for 2024.

FHA fund may be used just for no. 1 residences in most circumstances. As well as, the house should be a-one-to-four-tool house, townhouse, condo, cellular, are available, or modular home.

Of numerous loan providers and you can communities provide down payment assistance software to help you reduced-to-moderate-earnings FHA loan consumers. Such programs are made to advice about off payments, settlement costs, and other fees.

How to learn the best place to apply for a keen FHA loan?

To discover the best source for information to try to get an enthusiastic FHA loan, start with contrasting financial institutions, borrowing unions, an internet-based loan providers offering FHA financing. Choose FHA-accepted lenders once the not totally all establishments offer such fund.

Thought researching its costs, charges, customer service ideas, and you will ease of the application form techniques. On the web studies and testimonials can also bring understanding of borrower experience. Consulting with a large financial company makes it possible to choose lenders you to work best with the money you owe and you may domestic-to acquire specifications.

Would financial institutions bring FHA loans?

Sure, of many banks provide FHA finance. These types of funds is authorities-recognized, which enables banking institutions to give these with all the way down exposure. Higher finance companies, along with Wells Fargo, Pursue, and others, normally bring FHA funds, because do faster banks and you can borrowing from the bank unions. Yet not, confirming you to one lender are FHA-approved just before continuing which have an application is essential.

What can i look for in an enthusiastic FHA lender?

- Recognition status: Guarantee the lender is eligible from the FHA.

- Rates and charge: Evaluate cost and you can fees around the certain lenders to find the extremely cost-productive payday loan Lockhart options.

- Support service: A customer service can impact the feel, especially as an initial-go out homebuyer. Discover loan providers offering powerful service and you can information.

- Reputation: Browse the lender’s character compliment of analysis and you will critiques. Previous consumer knowledge can provide worthwhile skills towards what you you’ll expect.

- Mortgage handling times: Find out how long it entails the financial institution to help you process and you may close a keen FHA financing. Timing are going to be crucial during the aggressive construction areas.

Was FHA rates the same for all?

Zero, FHA prices won’t be the same for everyone. The federal government backs FHA finance, but individual lenders lay their pricing, that will will vary in accordance with the borrower’s credit rating, amount borrowed, and you will deposit. Additionally, markets criteria dictate the new costs offered by any given time. Shop around and contrast rates out of several loan providers to be sure you might be obtaining lowest price available.

Exactly what will disqualify you from a keen FHA financing?

- Reasonable credit rating: If you find yourself FHA finance become more lenient, a credit rating less than 500 essentially disqualifies your. Results ranging from 500 and 579 might require increased down payment.

- Higher personal debt-to-earnings proportion: It could be difficult to meet the requirements in case your debt-to-money ratio is higher than 57%.

- Foreclosure otherwise bankruptcy: Current foreclosure (during the last 3 years) or bankruptcy proceeding (during the last a couple of years in the place of good credit re-established) can also be disqualify you.