Design funds try essentially a primary-identity line of credit stretched to you personally to get your home dependent

- Or even get approved for long lasting financial support, you can deal with foreclosure.

Structure Loan Facts

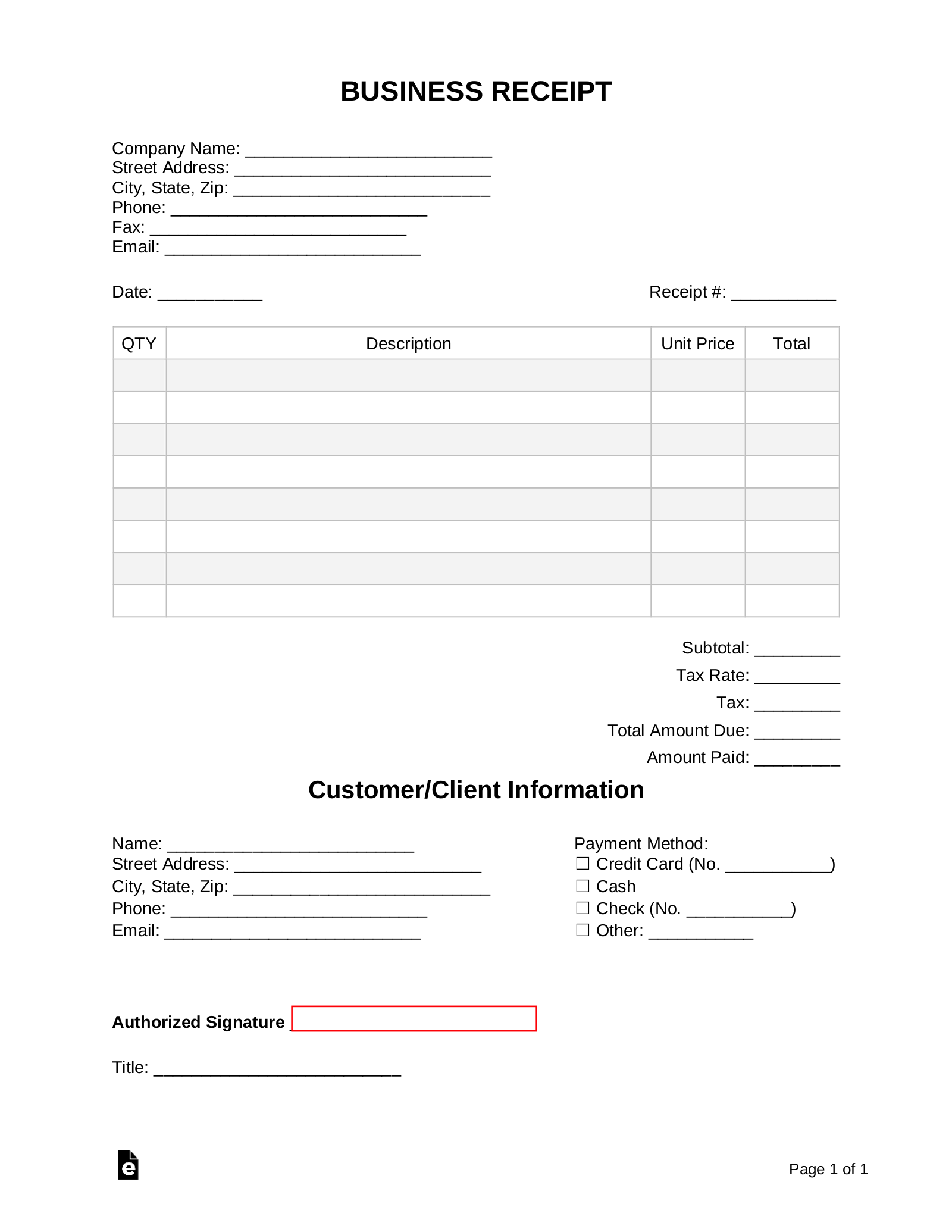

If you don’t explore all of the money, you have to pay interest for the money americash loans Coaldale lent. In the event the you’ll end up taking out a construction mortgage, their full loan costs should protection both difficult and you may softer will cost you. A frequent breakdown are shown below:

Dollars Down Costs. Which have structure funds, finance companies want the borrower to have some skin throughout the online game when it comes to dollars deposit. If you’re borrowing from the bank to your home and framework, you’ll typically want to make a hefty deposit out-of 20% so you can 29% of one’s accomplished property value new home and you can strengthening. The brand new deposit arrives at closing and will also be utilized to expend the first two payments on company. You to throws your finances really at stake – this is the ways the bank likes it!

Using House Given that Downpayment. The fresh homes is typically presumed so you can account for 25% in order to 33% of your own worth of new complete venture. For people who currently own brand new belongings, there will be a simpler day delivering a houses mortgage. New home have a tendency to matter as the customer’s equity in the project, and manage to borrow doing a hundred% of design prices for individuals who meet up with the loan conditions (credit history and obligations/money proportion) and accomplished endeavor appraises better.

Framework Loans to have Home. Funds both for homes and design are more complicated to obtain than construction-merely funds, particularly for bare belongings versus. a developed package when you look at the a great subdivision. Construction funds are also difficult when you find yourself purchasing the belongings from individual and employing which have some other to create our home. If you don’t provides detailed arrangements and you may a builder installed and operating, you want time for you to completed your arrangements and you will align a builder.

Whether your specialist enjoys finished $50,000 value of work and has been paid $75,100, neither your or even the bank will probably recover the real difference if the builder will leave town, goes broke, otherwise doesn’t work for reasons uknown

To safeguard oneself, you need to make any promote purchasing house contingent on having your structure resource acknowledged. Including create a lot of time into your give to apply for a build mortgage and possess accepted. The greater amount of believed you are doing beforehand, the greater.

Certain land and you can construction loans enables you to waiting months otherwise many years just before strengthening. At the same time, you’ll make month-to-month dominant-plus-attention money for the home portion of the financing. Check with your loan-office observe exactly what options are offered.

Contingency Supply. Because so many plans meet or exceed the borrowed funds matter, finance will often have a built-inside the backup of five% to 10% along side estimated pricing. To gain access to that it currency, you’ll need documentation in the way of a big difference acquisition, discussing the additional functions or even more expensive material picked together with resulting upcharge. Particular finance companies, however, does not buy transform with or as opposed to a difference buy.

Notice Set-aside. Several other peculiarity regarding structure money would be the fact many people create zero costs after all for the design stage. Provided that there is no need more income on your own pocket through the framework, very financing include a keen notice set-aside, that is money lent to you personally to really make the interest money. The cash is actually kept in a keen escrow account and you can paid down on bank since attention. The attention is known as a portion of the cost of structure by the the specialist, or from you just like the a proprietor-creator. The advantage is you don’t need to built extra bucks inside the design phase. The fresh downside is that you was borrowing extra cash.

Draw Schedule. Generally speaking, the financial institution does not want to disburse extra cash as compared to worth of brand new done functions. Neither are you willing to when you are hiring a broad contractor. As a result of this, both you and the financial institution, dealing with brand new contractor, will need to present a suck schedule in accordance with the worth of every phase of one’s works, named a timetable of viewpoints .