Access to capital is important your framework providers

Thus, it is important to understand the various types of loan providers that are out there. Away from heavier gadgets so you can team wages to help you insurance rates, major construction projects need major resource to acquire up and running.

- Commercial banking institutions

- Coupons and you will mortgage connectivity

- Mutual savings banking companies

- Financial banking institutions

- Term life insurance businesses

- Owning a home trusts

- Bodies organizations

- Alternative supply

But you choose to financing your own design investment, the most important thing that you get their investment quickly so that you get been. Extremely commercial design fund are set up in layers, where borrower can draw toward a schedule as specific tips of your own project get finished, you need to have about adequate capital in position so you can break floor.

While looking toward financial support a primary design project, the original place you will likely begin is by using a classic build financing using a major commercial financial.

A very important thing throughout the using a primary financial is the fact higher framework methods commonly cheaper, that have a life threatening mortgage necessary that usually takes age so you’re able to pay-off. You could potentially become sure whenever choosing to invest in your project thanks to a commercial financial that they’ll have sufficient information to fund your project plus the economic stamina to allow flexible payment terms and conditions.

Most commercial bank loans will need a downpayment of at the the very least 10%. This helps take some of your own dangers off of the lender by indicating them that your team keeps adequate financial collateral to manage a job out-of wider extent.

Likewise, extremely commercial finance companies give fixed or varying rates of interest and you can label lengths that last up to 25 years.

Wells Fargo

Wells Fargo also provides different lending tool getting enterprises lookin to handle a property endeavor, as well as secured loans, personal loans, https://paydayloansconnecticut.com/botsford/ and lines of credit. That particularly glamorous option given by Wells Fargo are an item also known as FastFlex, and therefore stretches a one-year line of credit regarding $35,000 into the organization at the mortgage of approximately fourteen percent.

Though you actually ever need to use the newest FastFlex alternative, its higher for positioned prior to starting a homes venture, since it will allow you to rapidly rating unanticipated content you to definitely can get appear on temperatures of the moment throughout an effective generate.

Wells Fargo’s software process is very easy to use, having various recommendations available. Indeed, if you are an excellent Wells Fargo representative, you will be capable incorporate and also have acknowledged for the framework loan rather than ever going into a part work environment.

Pursue

Pursue is another commercial lender which is often a choice to possess capital your design project. They offer several options that can help you get the opportunity off the ground, in addition to credit lines, organization term funds, and you may SBA money.

Pursue is the best choice to own huge organizations cracking surface into the grand-size ideas, while the a number of the SBA funds also have as much as $5 mil inside financial support over a phrase as high as 20 decades from the probably the most aggressive costs in the industry.

The newest drawback would be the fact it could be challenging to qualify for some of Chase’s more desirable loans, when you don’t possess an excellent credit score otherwise high collateral otherwise security, delivering approved for biggest resource as a result of Pursue tends to be a constant race.

U.S. Lender

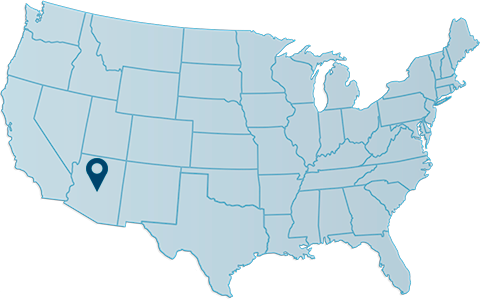

If you are looking to construct west of the fresh Mississippi, U.S. Bank may be the best bet to possess industrial resource, particularly if assembling your shed is quick otherwise mid-measurements of, and you’re seeking some short lines of credit.