Schedule off items because of the HOLC and you can FHA

The newest government government’s propagation away from redlining, beginning in the fresh 1930s, is generally attributed to a few houses funds apps established in one to decade: the house Owners’ Financing Enterprise (HOLC) as well as the Federal Homes Government (FHA). In the a recently available report, co-composed that have Price Fishback of one’s School away from Arizona, Ken Snowden of School off New york in the Greensboro, and you will Thomas Storrs of your own School out of Virginia, i attempt to most readily useful comprehend the historic part of each and every agency for the propagating redlining.

We ending one to, for the extent that red outlines taken into maps from the the us government got affects to the financial business, the fresh new yellow contours taken by the FHA was basically likely a lot more impactful as compared to HOLC’s. We find that the FHA mainly omitted key towns and you may Black colored financial borrowers from the insurance rates businesses, since HOLC failed to. Simultaneously, once the HOLC’s charts of cities remain renowned signs regarding general racism, our very own research signifies that it’s very unrealistic your HOLC maps were used to aid the mortgage market factors regarding sometimes the HOLC or the FHA. Rather, the brand new FHA put up its strategy to help you redline center urban communities, which it performed out-of big date among its surgery.

Out-of an insurance policy direction, it is res had been mainly based within same big date however, create instance comparing habits from pastime for the home loan markets. We advise that per agency’s trend of passion try a features of the legislative mandate. However, given that per agency had administrative self-reliance inside interpreting the mandate, empirical investigation out-of genuine pastime is very important.

Inside 1933, the us government based our home Owners’ Financing Organization (HOLC) once the a temporary system which have an effective mandate to simply help home loan consumers whom, offered monetary facts in the Great Anxiety, were from inside the hard straits by way of no fault of their own.

The second 12 months, inside 1934, government entities founded the fresh Government Property Administration (FHA) since the a long-term department that have a beneficial mandate so you’re able to guarantee finance you to definitely was indeed economically voice, while also demanding individual lenders giving lower rates and you can extended times than was in fact typically available. The new FHA was also intended to work with financing the latest construction, so you can revive this building business.

Each other enterprises set up maps one evaluated metropolitan communities. The brand new HOLC maps have received serious data partly because of the careful preservation. Alternatively, the newest FHA’s maps have been shed. Toward HOLC charts, predominantly Black colored areas had been generally noted red-a low rating. Many reports enjoys figured brand new HOLC charts propagated discriminatory lending means https://cashadvanceamerica.net/payday-loans-tn against Black People in america or other reasonable-income urban residents because of the institutionalizing current redlining methods.

Proof government propagation off redlining when you look at the Federal Construction Administration

I digitize more 16,000 fund produced by the fresh HOLC otherwise covered because of the FHA inside the three U.S. metropolises, covering every money produced by the latest HOLC from 1933 in order to 1936, otherwise insured of the FHA off 1935 to April 1940. step one With your data, i’ve several head findings.

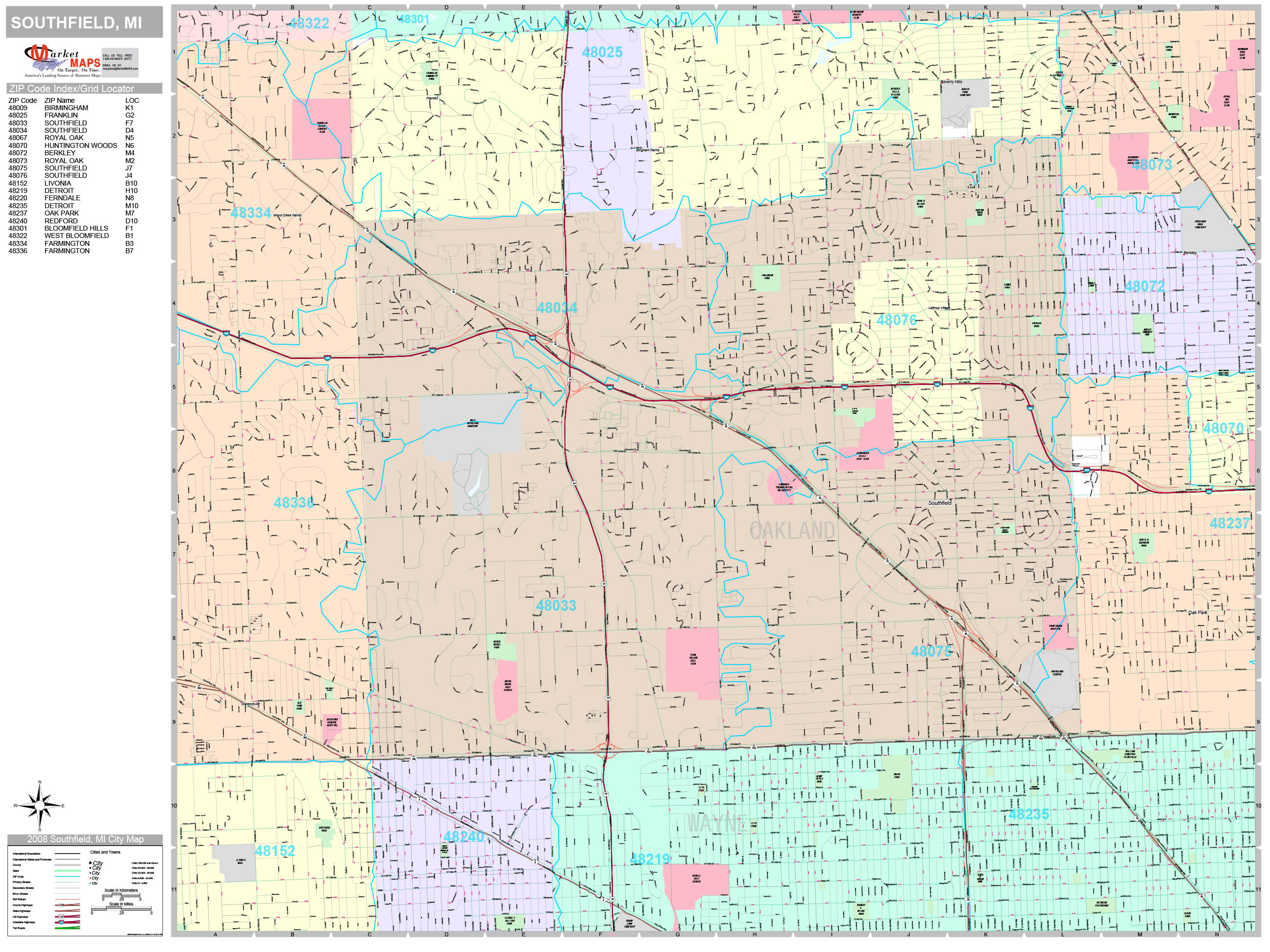

Earliest, new HOLC additionally the FHA got very different models out-of craft. Inside the each urban area, brand new HOLC made many more funds to neighborhoods within the portion at some point rated C or D (red) on the charts as compared to FHA. On top of that, brand new share regarding HOLC finance to help you consumers who have been Black colored are largely proportionate to the show out-of residents who have been Black. Alternatively, the FHA largely omitted Black borrowers and you may center metropolitan neighborhoods, and instead directed section which have the fresh new framework and better property viewpoints. For example, shape step one shows the fresh trend away from HOLC and you will FHA pastime in Baltimore.

step 1. HOLC fund (1933 so you’re able to 1936) and you can FHA-covered financing (1935 so you’re able to 1940) in the Baltimore, MD, layered into 1937 HOLC map

2nd, the brand new HOLC charts are produced just after this type of designs got become oriented. Brand new HOLC had currently made 90% of their funds just before its chart investment first started inside the 1935. Simultaneously, the latest FHA first started insurance rates functions up until the HOLC’s map program are circulated. We discover your FHA excluded core metropolitan areas and you will Black consumers off big date certainly one of the operations, hence their means shown absolutely nothing change adopting the HOLC charts are built.

Sessions for rules towards the mandates and you can institution businesses

Is it possible these two The latest Bargain apps had including different footprints for the financial markets? Because they was designed and passed within this a-year each and every almost every other because of the same Congress and you may presidential government, they’d different policy mandates.

Once the HOLC broadly loaned so you can Black borrowers, they performed very in the present program regarding segregation, refinancing money one already stayed. Alternatively, the brand new FHA try coached to help make an alternative system off loan insurance rates you to departed from inside the key suggests off current practices. From inside the white of your own failure of home loan insurance vendors throughout the 1920s, the FHA was trained while making just financially voice loans-an expression that the FHA interpreted as a good mandate to end key metropolitan areas or those people whose racial constitution might possibly end up being in flux. Neither system are tasked with defying the present activities off segregation, and you will neither performed.

An unusual class out of FHA-insured funds from your data drives family this aspect. In Baltimore anywhere between 1935 and you can 1940, we discover only twenty five Black houses one to received financing insured of the the fresh FHA (than the a huge selection of finance to Black colored consumers made by the latest HOLC). A big share of them FHA-insured financing went to house into the Morgan Playground, an upscale community nearby the over the years Black colored academic organization now-known because Morgan Condition School. Morgan Playground appears to have been the newest rare Black colored neighborhood that met this new FHA’s underwriting standards, which have limiting covenants barring Light occupants and new, high-top quality residential district-build homes.

All of our research leaves no doubt the life and legacy out-of redlining are actual. I dispute, yet not, one for the extent you to federal providers institutionalized redlining by the attracting specific boundaries, this largely taken place through the FHA.

step 1 The shot off funds come from county practices within the Baltimore City, Maryland; Peoria, Illinois; and you may Greensboro (Guilford County), Vermont.