Would Student loans Apply at To order a property? What Millennials Should know

Once the millennials even more go into the housing market, another type of question looms: is it possible you purchase a house which have education loan loans? With respect to the Federal Organization off Real estate agents (NAR), plenty of homebuyers possess beginner loans. Indeed, an entire 41% of earliest-go out home buyers perform. Anytime you have been doing work underneath the assumption you to student education loans suggest you simply can’t end up being a homeowner, think again!

Just before rushing on the mortgage mentor, whether or not, discover several things you have to know. This is what you should know about figuratively speaking and purchasing a home.

Carry out college loans connect with to invest in a property?

Since the we now have noted, you can however purchase a home that have college loans – and many anybody carry out. The second logical real question is, how can your own funds impression your house buying feel?

The clear answer: college loans can impact the debt-to-money proportion, credit history, additionally the number it is possible to rescue for a down-payment, and all these circumstances subsequently can affect the loan rates and you will mortgage you might be eligible for. Let’s next crack one off.

Debt-to-income proportion

Anytime you check out purchase a property, you can talk about budgeting with one another your Realtor plus home loan mentor. More loans you have equal in porportion towards income, the shorter home you could potentially essentially manage. Put another way, student education loans could possibly get imply that you qualify for a less costly home than your otherwise you certainly will pay for along with your income peak.

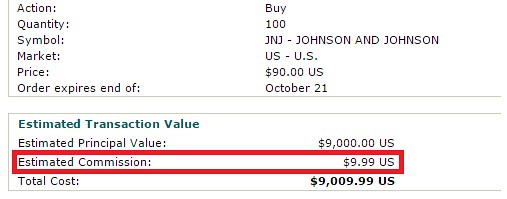

Debt-to-earnings peak, or DTI, is dependant on your own monthly financial obligation money – and that covers anything from automobile repayments to playing cards. Normally loan providers prefer good DTI out-of thirty six% or faster, having 43% as the high DTI a borrower have when you are however being qualified to own a mortgage. Yet not, so it amount might be higher which have authorities-recognized mortgages (such as the FHA).

With an educatonal loan will not stop you from taking recognized having home financing. Student loan payments was determined like any almost every other personal debt whenever trying to get home financing, teaches you educated Financial Coach Beam Garville. Like other required repayments, student loan money get mentioned for the what’s known as personal debt-to earnings-ratio to possess choosing simply how much away from a home loan we are going to meet the requirements to own. If there is a monthly payment said towards the a credit history, that is the commission and is put.

Credit rating

Create student loans apply at credit ratings? They may be able. How undoubtedly you have taken the loan obligation yet usually has inspired your credit rating. If you have generated your student loan commission on time each month, you should have a high credit history. If you’ve overlooked repayments – if not defaulted towards a few of all of them – your get might be reduced. A minimal credit history means high financial rates, for example large monthly obligations.

Education loan payments was claimed towards the credit bureaus like other costs and then have an effect on a credit rating; in the event the you’ll find late money it’ll have a terrible perception to the a credit score, of course paid off because the concurred it’ll have a positive perception into the a credit history, cards Garville.

Advance payment

Generally, its best if people pay 20% of its house’s value in the closing. That it advance payment, as the called, assists in maintaining financial pricing and you will monthly premiums realistic and you may allows people to quit the excess commission from Individual Home loan Insurance coverage (PMI). Millennials who may have had to repay their funds if you find yourself performing regarding at entry-peak perform you should never usually have a lot of cash on lender when it comes time to find a property.

However, first time household customer software normally make it homebuyers to place down as low as 5% within closing – which means this may possibly not be while the huge problematic since you think it is.

Do i need to pay-off debt before buying a house?

Potential home purchasers tend to ponder whether they should pay-off their college loans otherwise pick a house. There isn’t any correct respond to right here, especially as level of loans you have, how quickly you could potentially pay it off, and also the form of household we need to be eligible for most of the perception which choice.

- The reason many home owners end up buying a home while using out of figuratively speaking is because of deciding on their overall financing picture. Annually, the cost of casing sometimes rise, since do interest levels. For those who pay off $20,000 from inside the beginner loans, but the cost of your prospective household increases $20,000 across the couple of years you might be saving, in that case your total financing burden hasn’t shifted much.

- For those who have large-desire loans, regardless if, it may make sense to blow these away from basic.

- Because the that have a more substantial deposit will help keep financial price straight down -and even half a share rates can be mean tens and thousands of bucks along side lifetime of the loan – it creates so much more experience to keep for the advance payment rather of your own education loan.

- For those who delay purchasing a house, you will be paying to lease alternatively. When you shell out the financial, which is guarantee you are able to remain. Once you rent, you happen to be nonetheless paying a mortgage – but this is your landlords.

To shop for a home with student loans in the deferment

When you yourself have deferred student education loans – which means that youre into college, regarding armed forces, otherwise is have demostrated economic difficulty (federal college loans was and additionally deferred getting on account of COVID) – you happen to be wondering exactly how it affects your ability to shop for a property.

When you are choosing a keen FHA loan: Typically, FHA lenders are required americash loans Magnolia to explore step one% of one’s education loan equilibrium as part of the monthly obligations when choosing whether the debtor fits the maximum debt so you can money ratio from 43%.

Quite simply, for many who are obligated to pay $20,000 inside the college loans, lenders will imagine step one% of the – otherwise $2 hundred – to be their monthly mortgage duty, even though you’re not required to spend any one of it down immediately.

Antique finance usually are more easy than just FHA guidance, when you carry a high education loan financial obligation, you might find ideal success truth be told there.

That have college loans and purchasing property is common

College loans are just a variety of loans, and you may obligations itself does not hold some one straight back out of to get homes: indeed, most people to purchase property involve some types of financial obligation, should it be beginner loans, auto payments, otherwise credit card debt. What you need to create try keep credit rating up, see the debt-to-income proportion observe how much cash family you can afford, and you may correspond with a qualified, ideal Realtor on what type of household can suit your need and you can finances.