Point 184: Lenders Only for Local People in america

The fresh Area 184 Loan Be sure Program try only available for Indigenous Us citizens or Alaska Natives because people in federally acknowledged people. Brand new Houses and you can Area Creativity Operate away from 1992 composed this program to address having less mortgage loans in Indian Country.

What makes mortgage lending unavailable for the Indian Country?

A lot of the land in Indian Country are kept inside several ways. Mainly, the us authorities has the fresh new end up in believe towards the benefit of a certain tribe. Almost all of the rest of the tribal house try stored when you look at the believe with the benefit of individual Native Us citizens.

Due to its tribal trust reputation, loan providers usually do not lawfully home loan you to definitely homes. At exactly the same time, home stored into the trust for anyone need to discovered approval out of brand new Agency of Indian Issues (BIA). Therefore, as lenders cannot financial and you can foreclose toward a house, or set good lien towards private faith property, they’re not generally capable bring lenders in order to private Indigenous People in america.

Why does a part 184 Financial really works around this matter?

Area 184 finance are available for have fun with both off and on tribal residential property. The latest eligible candidate renting this new house about group for fifty many years. The loan relates to our home and also the leasehold appeal, however the latest residential property by itself. Henceforth, the fresh new homes stays from inside the believe into the tribe. The fresh Part 184 mortgage can be acquired to help you safe from the leasehold desire as opposed to the residential property.

Point 184 is an excellent HUD Financing, however FHA

Although many of Gordonville loans one’s financing qualities and requires are similar to FHA mortgages, it is very important observe that a part 184 loan is not an enthusiastic FHA financing. These types of finance come from HUD’s Office of Local American Software.

A qualified candidate is applicable into the mortgage which have a loan provider whenever you are handling the latest group and you may Agency out of Indian Things. The financial institution evaluates the mortgage documentation and you can then submits the mortgage to own approval regarding HUD’s Office from Financing Make sure.

Down Costs and you can Underwriting Conditions

Brand new Part 184 loan requires a lower advance payment than traditional otherwise FHA financing. For a loan count more $fifty,100, brand new down-payment is actually dos.25% of the sales speed. At the same time, for a loan count below $fifty,one hundred thousand, new downpayment are step one.25% of the sales speed.

Even better development: individuals are able to use both provide financing or gives to the down commission once they don’t possess all of their finance offered. The fresh underwriting standards getting a paragraph 184 mortgage are more than simply all other financing systems. These are typically way more versatile into Bankruptcy proceeding timeline conditions, and minimum expected borrowing from the bank profile.

Eligible Candidates and you may Functions

This new candidate should be an american Indian otherwise Alaska Local whom is actually a person in a good federally acknowledged group. To the done directory of federally accepted tribes, click on this link.

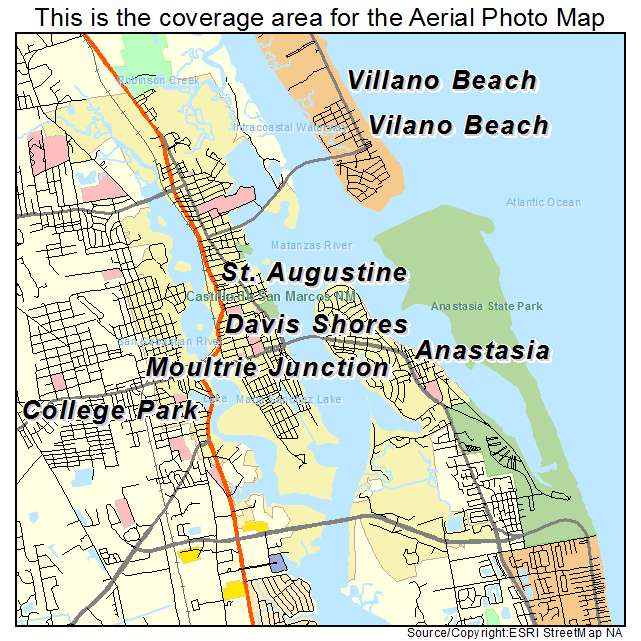

Qualified possessions have to see FHA structure and you can safeguards requirements. Applicants need certainly to reside in the house because their top quarters; for this reason, the brand new Point 184 mortgage is not for second belongings or leasing properties. not, so long as brand new buyers live-in among units, our home possess to 4 tools. Land also needs to be located contained in this a qualified town. For more information, you might follow this link to possess a list of eligible portion.

Ineligible Financing Characteristics

The Point 184 mortgage is actually for fixed-price finance merely, which means this program does not allow it to be Variable Price Mortgage loans (ARMs) otherwise Interest-Just funds. While doing so, industrial attributes try ineligible for it program. Maximum financing restrictions in addition to are very different of the condition. You could click on this link getting a listing to find out what the newest limitation is actually for your state.

The new Part 184 loan is actually another way for Indigenous Us americans to buy their own house. Not absolutely all lenders can offer that it financing, and therefore financing program is considered the most a type.

Are you experiencing questions regarding how the Part 184 Financing you may work for you? Fill out the design less than otherwise e mail us now!